Global Market and Economic Perspective

Global Economic Commentary

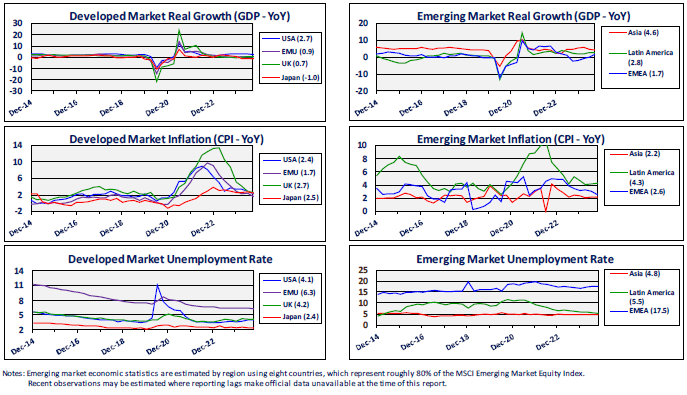

- Growth in real output in the US continued to outpace real GDP growth in other developed economies during the third quarter. Strong consumer spending, especially in durable goods, was the largest contributor to the nearly 3% GDP number. In contrast, investment spending was soft, with residential and non-residential structures particularly weak. After a fairly long spell of little growth or even decline, defense spending by the Federal government also rose strongly. The solid data have started to call into question whether the Fed will continue to aggressively cut rates, as had been expected earlier in the year.

- Real growth in the Eurozone was low – less than 1% annualized – but was actually a bit better than consensus expectations. Despite continued weakness in the Japanese economy and a deceleration in inflation, the BoJ hiked their policy interest rate to 0.25%. China remained mired in a property market downturn, which has adversely affected debt markets and left GDP growth below the government’s 5% target.

- Inflation in most developed countries outside the US remained very low. In the US, inflation continued to run above the Federal Reserve’s target of 2%. The Fed’s preferred measure – PCE deflator – fell to 2.1% year-over-year in the third quarter. Unfortunately, the core PCE measure appears to be “stuck” around 2.5% y-o-y, which could presage a mild resurgence in the full PCE inflation measure.

- The unemployment rate in the US has risen off its 2023 lows, but much of this has been driven by increased numbers of entrants into the labor force rather than layoffs or economic weakness.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

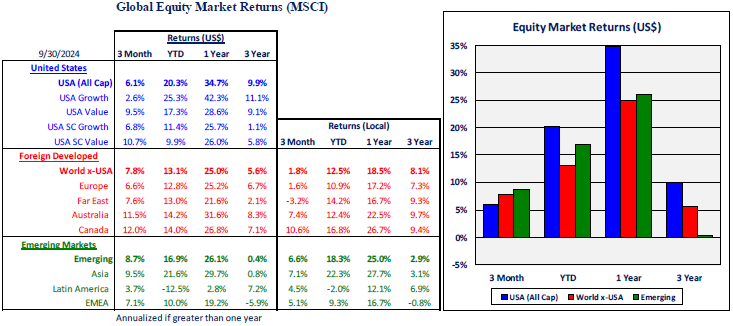

- Equity markets worldwide produced strong returns in the third quarter. In the US, the value sector and small-cap stocks had a good quarter, although their returns were not good enough to overcome their underperformance relative to growth and large-cap stocks in the first six months of 2024. The US market continued to benefit from strong US economic growth and productivity gains.

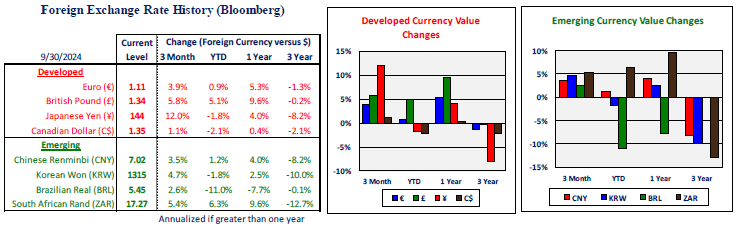

- Outside the US, developed markets equities and emerging markets equities delivered nearly identical returns. The source of the returns differed substantially, however. In developed markets, three-quarters of the return in Q3 came from currency strength relative to the US dollar. In emerging markets, that was reversed, with three-quarters of the return derived from local equity market returns and only a quarter due to currency gains. The Australian and Canadian equity markets, traditionally viewed as “commodity” countries, produced particularly strong returns. The Chinese stock market rallied in late September on the government’s announcement of a large stimulus package. It remains to be seen whether this will provide any lasting structural help to China’s economy and markets.

- Dollar weakness during the third quarter was attributed by many observers to the expectation that the Federal Reserve would be fairly aggressive in cutting interest rates. This would reduce the large yield advantage of US short-term bonds over non-US instruments. As a result, dollar investments were expected to become less attractive.

US Fixed Income and Fed Commentary

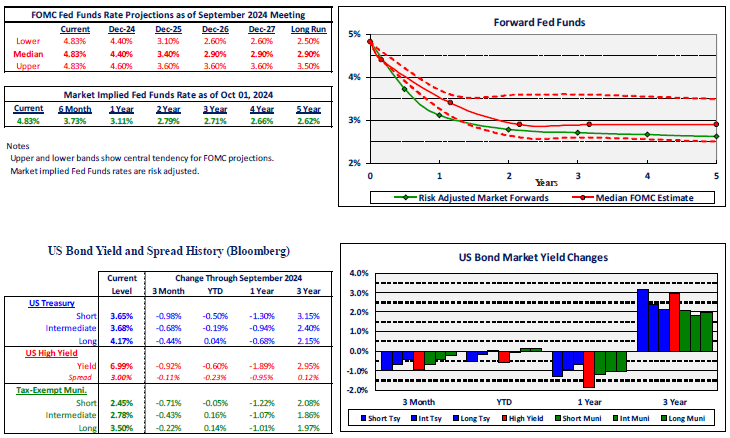

- Until shortly before the Federal Reserve meeting in mid-September, consensus expectations were that the FOMC would cut the Fed Funds policy interest rate by a quarter percentage point (25 bps). However, as the date of the meeting approached, expectations shifted toward a 50 bps cut, which is in fact what the FOMC delivered. Despite inflation not yet having returned to the Fed’s 2% target and fairly robust economic growth, Chairman Powell stated that they felt a 50 bps cut was warranted because of an expected softening of the labor market.

- During the quarter, the yield curve finally moved to a more-normal upward sloping posture. For a long time, short-term interest rates were higher than long-term rates. But, with the Fed embarking on a course of cutting its short-term policy rate, the bond market finally reversed the inversion and priced long bonds to yield more than short bonds.

- As bond investors came to anticipate the FOMC’s action to reduce interest rates, yields declined across maturities. As yields fell, bond prices rose and produced strong returns to most fixed income sectors, especially longer-term bonds which are the most sensitive to interest rate changes.

- In addition to declining yields, credit spreads narrowed modestly as equity markets rose. The spread narrowing further boosted returns on corporate bonds, high yield, and emerging market debt.

Stairway Partners, LLC © 2024

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.