Global Market and Economic Perspective

Global Economic Commentary

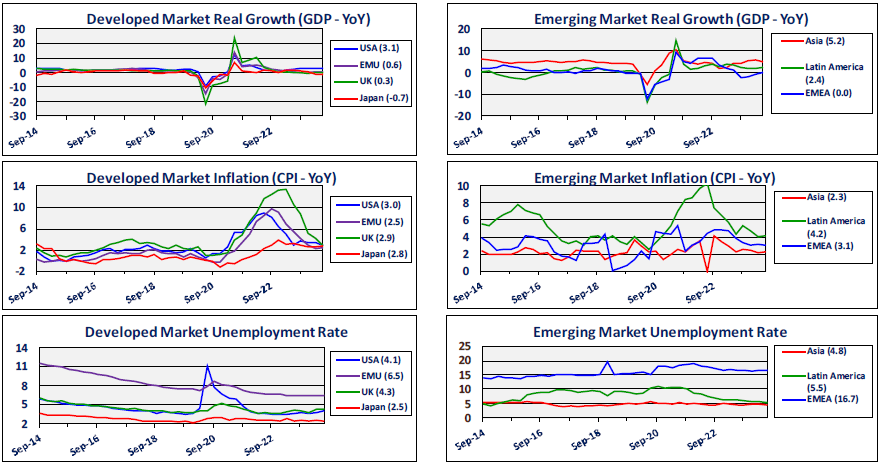

- Real GDP growth in the US surpassed expectations in the second quarter, buoyed by strong business investment, and consumers who remained willing to spend on goods and services. Consumption again grew at a faster rate than real incomes, which perhaps can be attributed in part to the “wealth effect” of strong equity markets and buoyant housing prices. One dark spot in this picture is the unevenness of consumers’ financial health: lower-income households appear to be struggling with their debt loads and cost-of-living issues due to elevated inflation over the last several years.

- Outside the US, growth was mixed during the quarter: despite a small decline in German GDP, the broader Eurozone saw a moderate expansion. China’s economy also turned in a positive GDP number, although the annualized increase was slightly below the government’s 5% target for the year. The Chinese government continues to grapple with real estate issues and overinvestment in public works projects.

- In many countries, the moderation in inflation from its Covid-era peak has stalled in 2024. Central banks, most of which had been aggressive in hiking short-term interest rates to address inflationary pressures, now have shifted toward monetary easing. Interest rate cuts and changes in forward guidance have generally preceded inflation fully returning to the targeted rates.

- The combination of decent growth and policy easing has resulted in unemployment remaining low in many regions.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

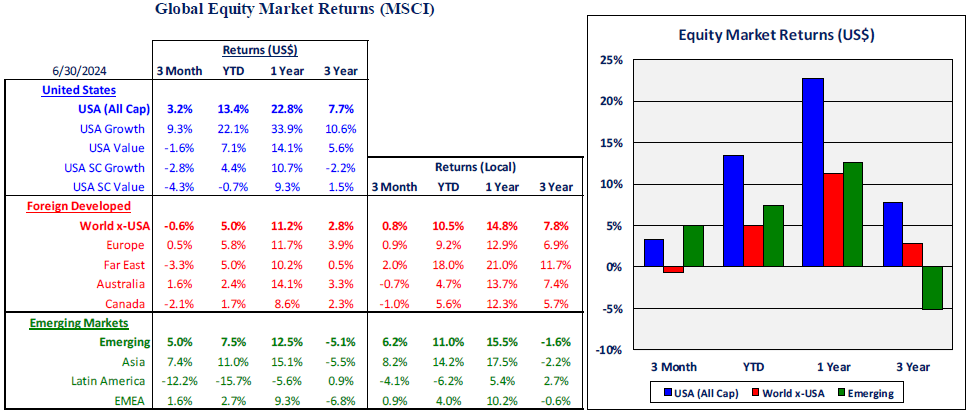

- Returns in US and emerging equity markets were fairly good during the second quarter. However, these broad returns masked some fairly substantial differences within the asset classes. In contrast, the return to non-US developed equities was considerably lower, as small positive local market returns were more than offset by US dollar strength.

- In the US, the large-cap growth sector – and specifically a small number of the largest tech stocks – accounted for the bulk of the equity market’s positive performance. Value stocks and small caps were lackluster at best.

- The weak performance of non-US developed markets during the quarter occurred despite continued good growth of the companies’ operating earnings. In the Eurozone and Japan, the trend in earnings has been nicely positive for the last few years, despite some economic softness in Europe. In some markets, equity returns have been subdued because of pricing; investors have been placing lower P/E ratios on non-US earnings than those in the US.

- The recent picture is quite different in emerging markets, where earnings growth has been sluggish, but investors have begun to price these markets at somewhat higher premiums.

US Fixed Income and Fed Commentary

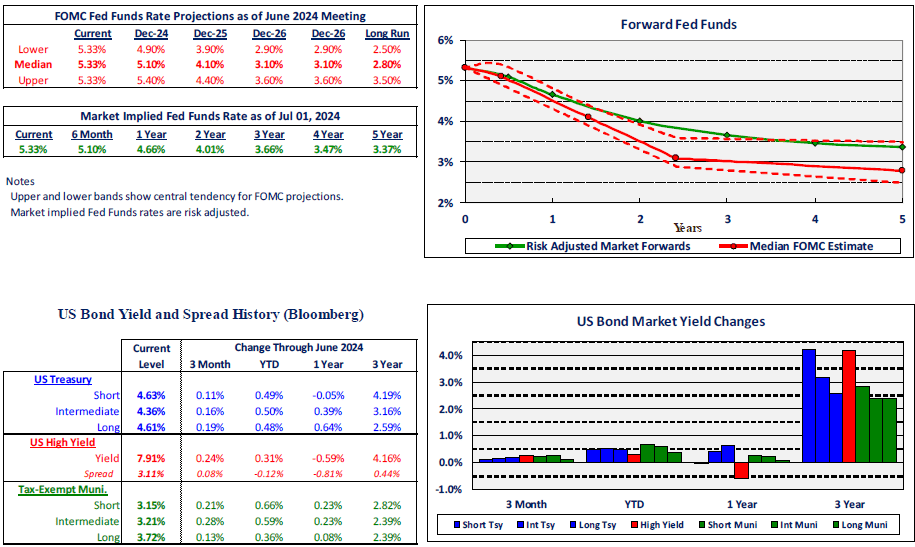

- Yields in the Treasury market moved during the second quarter much as they did in the first – rising rather sharply at all maturities. Because bond prices move inversely with yields, this increase in the Treasury yield curve produced price declines, with longer-maturity bonds suffering more than shorter-term instruments. A few years ago, this would have produced substantial losses to investment-grade bonds. However, because interest rates and yields are much higher these days, interest income on many short and intermediate bonds is sufficient to offset the price declines. Only on longer-term bonds was the total return negative during the quarter.

- The Federal Reserve’s Open Market Committee (FOMC) held two policy meetings during the second quarter – early May and mid-June. As expected, the FOMC did not change policy, keeping the Fed Funds rate unchanged at a range of 5.25%-5.50%. Although they have not changed the policy rate since the last increase at their July 2023 meeting, the Fed’s balance sheet continued to shrink. They are maintaining a stance of letting bond holdings “roll off”, which means that proceeds from maturing securities are not reinvested in new bond purchases. The Fed’s total assets are now lower than they were more than 3 years ago at the end of 2020.

- Market expectations continue to show the Fed cutting interest rates at least once before the end of this year. This is despite the Fed’s preferred inflation measure (PCE deflator) plateauing around 2.5%, still above their target of 2% annual inflation.

Stairway Partners, LLC © 2024

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.