Global Market and Economic Perspective

Global Economic Commentary

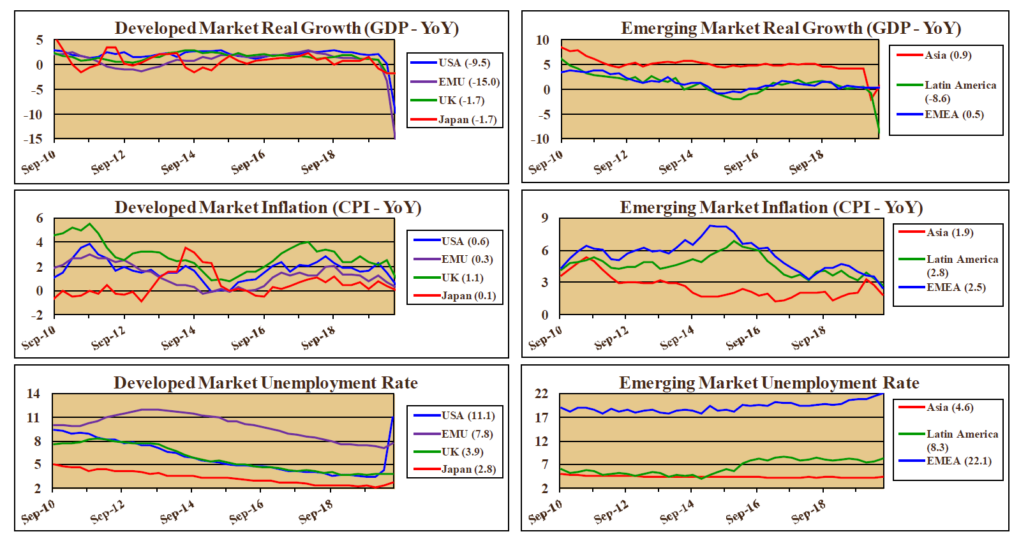

- In our first quarter Market & Economic Perspective piece, we stated that the economic impact of the coronavirus would not be seen until the second quarter. Now that much of the data are available, we saw that the US suffered the swiftest start to a recession ever, and the sharpest decline in output in a single quarter, as real GDP fell by 9.5% compared to the same quarter of last year.

- The lockdowns and stay-at-home orders in many states shuttered large swathes of the economy – such as airlines, hotels, and restaurants. Even health care suffered, given that many people largely avoided seeing doctors or going to the hospital except in the most serious of conditions.

- As a result of the economic dislocation, the labor market went from the strongest in 50 years, with the unemployment rate at 3.5% in February, to the worst since the Great Depression, with unemployment hitting 14.7%. Initial claims for unemployment insurance jumped from around 200,000 per week to nearly 7 million. Continuing claims were around 25 million during May.

- As a result of the drop in demand, inflation pressures evaporated. Core CPI dropped 0.4% for the month of April, the largest one-month decline in over 60 years. In addition, for a short time, oil futures prices went substantially negative. Traders were in effect paying oil buyers to take oil off their hands.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

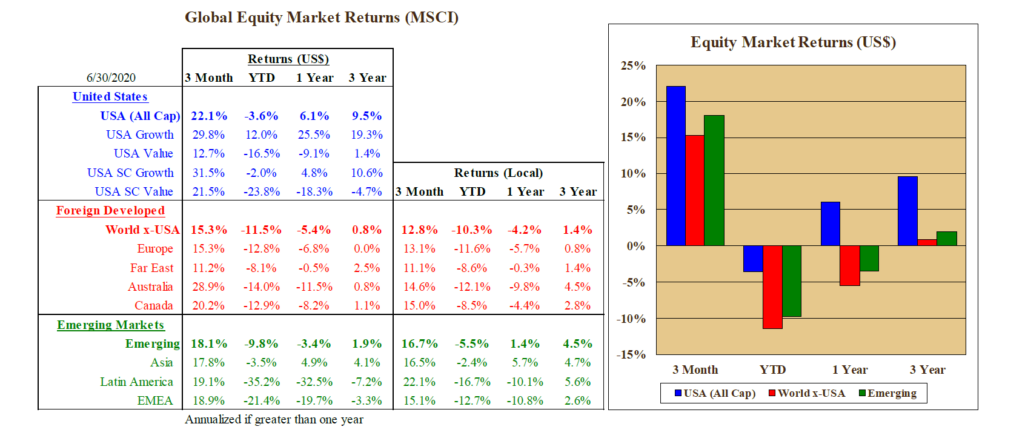

- After the very sharp equity market declines in February and March, the rebound in stock prices in the second quarter was remarkable. Although the broad US equity market did not manage to return to the record peak of the first quarter, the year-to-date loss was only about 2.5% by the end of the second quarter. The largest tech stocks contributed a considerable amount to the recovery.

- Second-quarter earnings expectations were clearly not driving the price recovery, given that we are likely to see very substantial declines in profits as companies release their earnings. According to FactSet, who combine reported earnings and estimates for companies that had not yet reported, at the end of July expectations are that second quarter S&P 500 earnings will be down 35%.

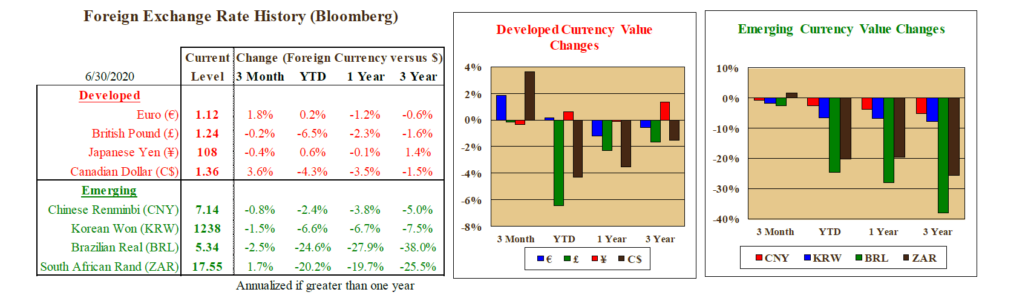

- The US dollar weakened during the quarter against the currencies of most developed and emerging market countries. This boosted non-US equity returns for a US investor.

- Equity markets outside the US saw much the same pattern as the US did – a strong rebound during the second quarter, but not quite sufficient to produce a gain for the year-to-date period. Emerging markets performed better than non-US developed markets, even though emerging market currency strength was a bit less than developed market currencies.

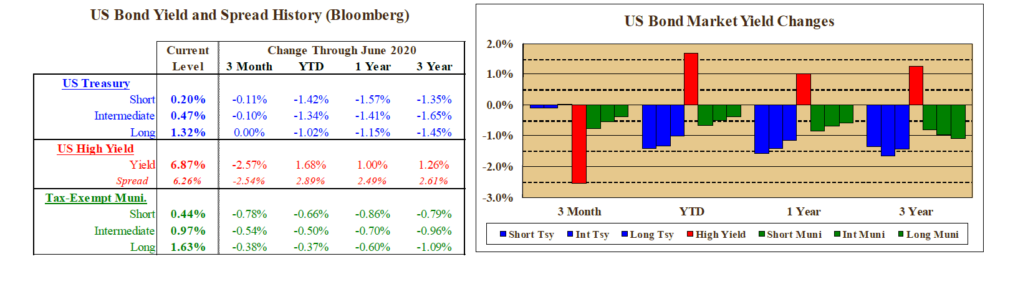

US Fixed Income and Fed Commentary

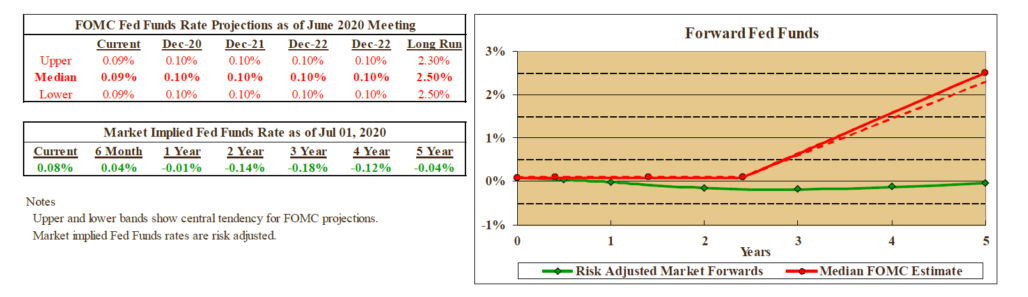

- US fixed income markets produced strong returns during the second quarter. Yields on Treasury bonds declined somewhat during the quarter, despite the enormous increase in government borrowing. As a result of the stimulus programs, the Treasury borrowed well over $2 trillion in just three months.

- One reason that the borrowing did not cause a jump in interest rates is because the Fed continued to massively expand its bond purchases, with a concomitant increase in its balance sheet. In addition to its purchases of government debt, the Fed widened the types of debt it was willing to fund with the backing of the Treasury Department. This even included the provision of financing for small businesses.

- With stock prices rising strongly, bonds with credit exposure also performed well. Returns in the investment-grade corporate bond market and in the high yield market were very strong, on the order of 9% to 10% for the quarter.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.