Global Market and Economic Perspective

Global Economic Commentary

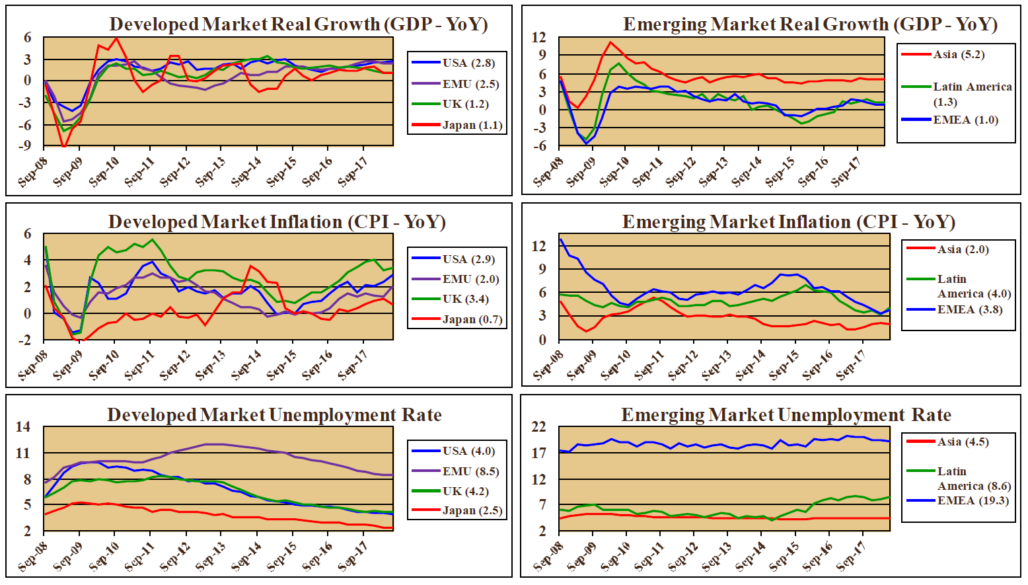

- The second quarter of 2018 saw US real GDP growth continue its upward trend. The advance estimate was a rate of 4.1%. This was driven in part by strong consumption, as household finances continue their decade-long improvement. Strong export growth was also a factor; many attribute this to exporters delivering goods before tariffs took effect (which should be reversed in the 3rd quarter GDP number). The unemployment rate briefly dipped below 4.0% during the quarter, the lowest rate in nearly 20 years.

- After a strong 2017, trade tensions have led to weakening economic growth in the Eurozone in both of the first two quarters of 2018. In the UK, uncertainty related to Brexit, and the seeming inability of the British government to make much progress on a plan for it, have caused many businesses to postpone investment.

- Weaker financial markets in the emerging markets are pointing to potential economic softening, due to the ongoing uncertainty of the trade war hostilities. However, this could certainly be a situation in which there is considerably more smoke than fire.

- Inflation has risen modestly (but remains low) in many countries, although the UK is again a bit of an outlier, as its retail price index has been in the 3% to 4% range for the last year and a half. The blame is likely to fall on Brexit here too, as the weakness in sterling has fed into higher import prices.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

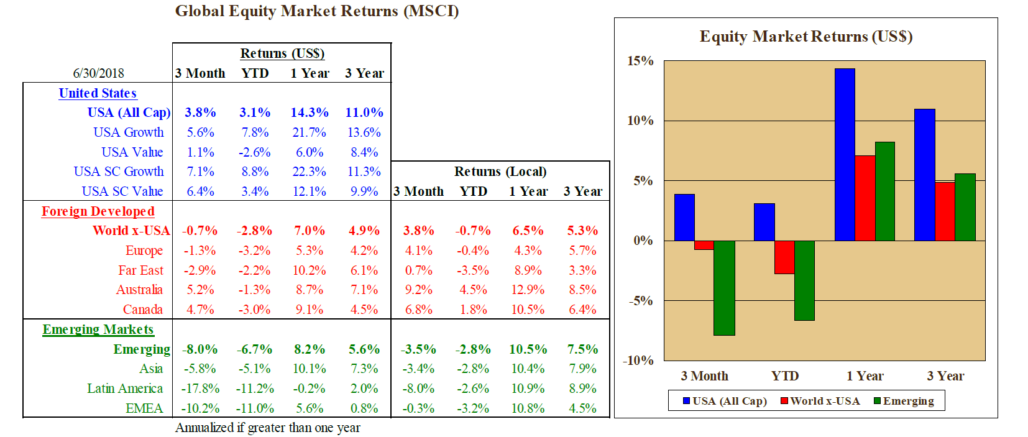

- In the US, the growth and small-cap equity sectors performed well in the second quarter. The FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google/Alphabet) contributed a good deal to the returns in the overall market and the growth sector. Small capitalization stocks benefitted from the focus on domestic companies, as trade concerns weighed on more internationally oriented firms.

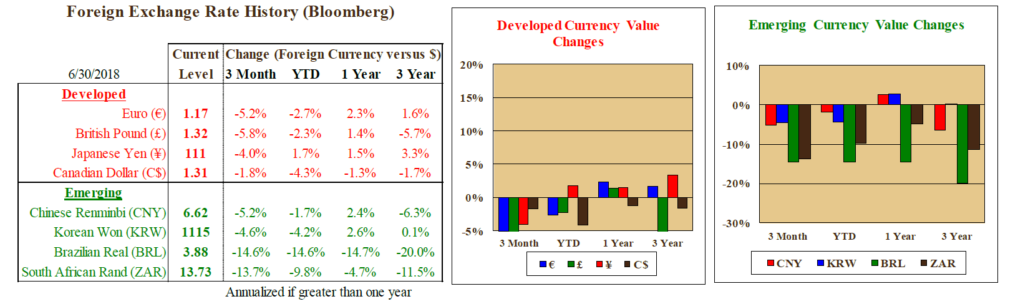

- When measured in their own local currencies, developed equity markets outside the US produced an aggregate return for the quarter that matched the return in the US equity market. However, due to ongoing US dollar strength during the quarter, the return to US investors from holding non-US developed market equities was slightly negative.

- The return in emerging market equities was negative, as fears of a slowdown in trade (and consequently in overall activity) hit share prices. The negative return in local currency terms was reduced further by the strength of the US dollar.

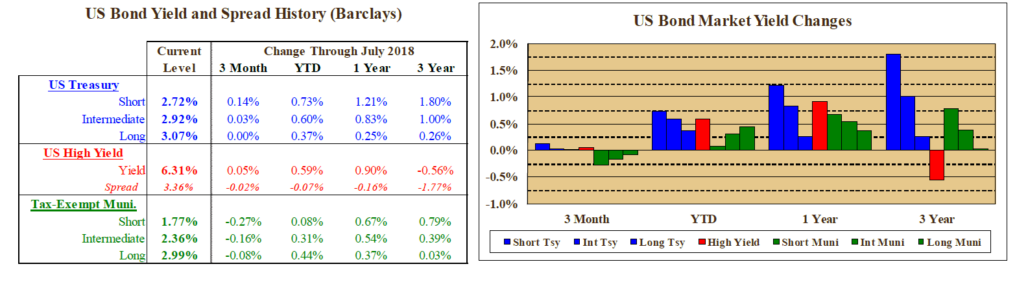

US Fixed Income and Fed Commentary

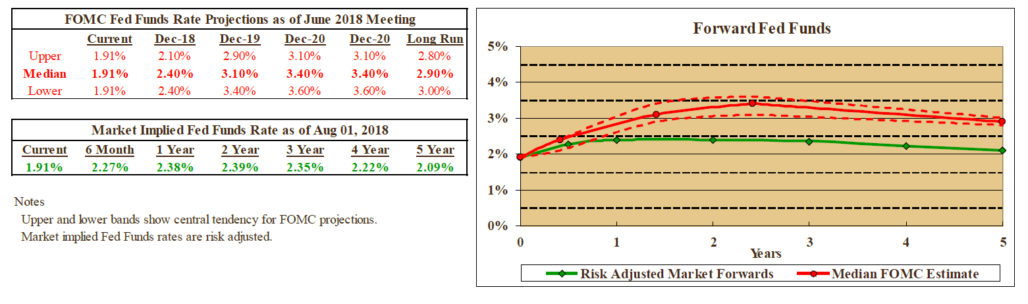

- In mid-June, the Federal Reserve raised their short-term interest rate – the Fed funds rate – by another 0.25% (one-quarter of a percentage point). This was the second increase in 2018, and it brought the Fed funds rate to 2.00%. The Fed’s own forecasts are for another two increases this year, which would leave the Fed funds rate at 2.50% at the end of 2018.

- The move by the Fed resulted in further increases in other short-term interest rates, such as the yields on Treasury bills.

- Because the yield on long-term US Treasury bonds barely rose during the second quarter, the yield curve became even flatter. The spread between short-term and long-term bond yields is now at its lowest level since before the financial crisis a decade ago.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.