Global Market and Economic Perspective

Global Economic Commentary

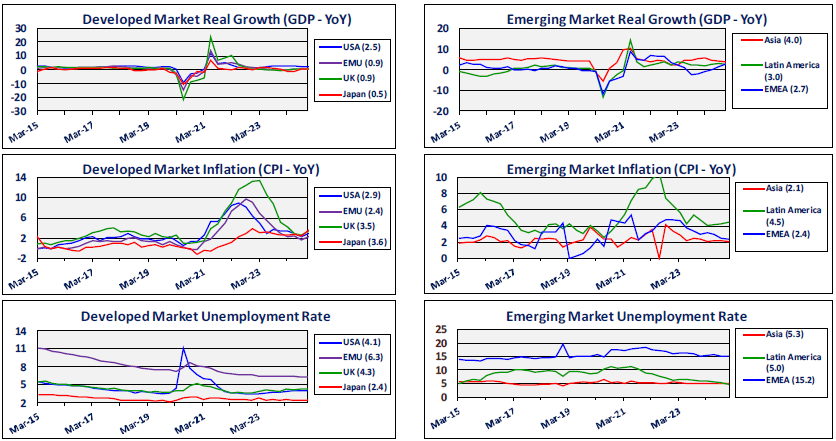

- Real economic growth differed substantially across countries during the fourth quarter. Although a bit below expectations, the US again produced a relatively strong increase in GDP which brought 2024 full-year growth to around 2.8%. China reported that growth in 2024 was 5%, matching its target. However, government stimulus was a significant positive factor, offsetting continued debt problems and a severe property market downturn. In Europe, the picture was “reversed” from previous years: the German economy was very weak in the fourth quarter, while southern European countries produced stronger growth.

- Inflation across the world looked similar to the growth situation. In the US, although the inflation rate has fallen from its pandemic-era highs, it remained stuck at a level higher than the 2% target expressed by the Federal Reserve. In contrast, inflation continued to fall in the Eurozone as growth softened, leading the European Central Bank to cut its policy rate by more than 125 basis points in the latter half of the year. In Japan, prices were surprisingly firm and the Bank of Japan responded by hiking its policy rate twice during the year to a positive level for the first time in 17 years. Relatively weak growth in many emerging markets has resulted in subdued inflation pressure.

- Unemployment during the fourth quarter remained at or near its recent lows in most countries, despite economic softness in some areas. US employers continued to add more workers to their payrolls in order to meet demand, and layoffs remained at low levels consistent with a healthy economy.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

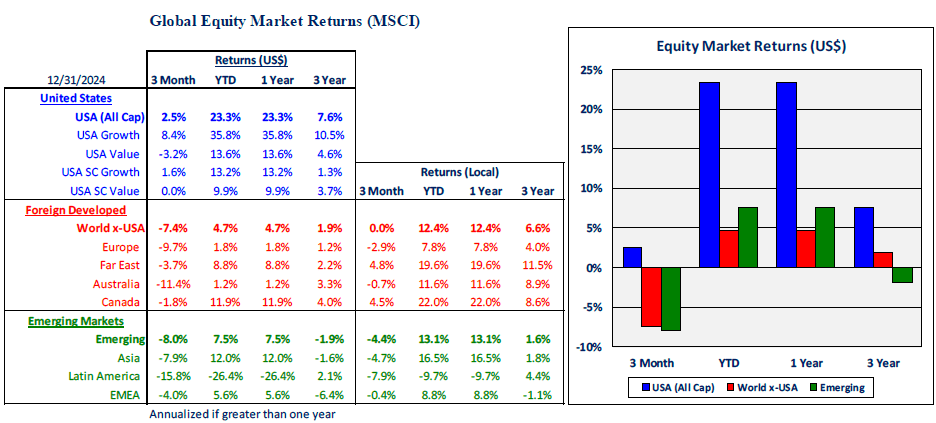

- In what seems to be a theme for 2024, the largest tech stocks turned in outstanding performance again during the fourth quarter which pushed the large-cap growth sector’s return to 35% for the year. In comparison, returns to value stocks and small caps were slightly negative or just above zero in the quarter. Nvidia in particular was boosted by heightened expectations of accelerating chip sales due to adoption of Artificial Intelligence models.

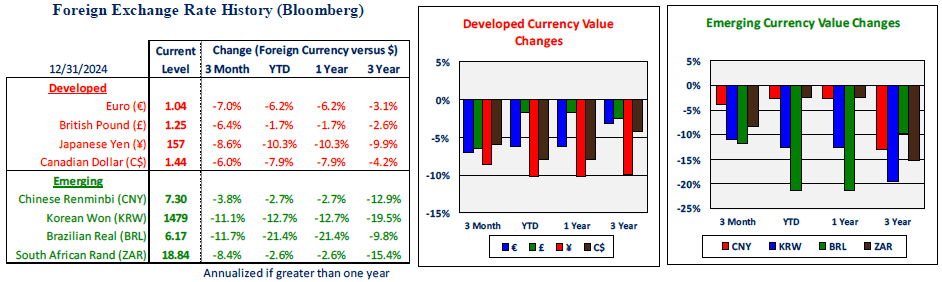

- The non-US equity market asset classes, both developed and emerging, performed poorly with losses of 7%-8% during the quarter. In developed markets, the loss resulted almost entirely from a stronger US dollar, as the local markets return was essentially zero. The loss in emerging markets was nearly evenly split between local market declines and dollar strength.

- Dollar strength relative to foreign currencies can be attributed to two highly-related factors. A primary driver was the increase in yields in the US. As interest rates rose in the US and non-US rates remained largely stable, US fixed income became more attractive relative to non-US bonds. The increased demand for US assets thus pushed the demand for dollars higher. The second, related factor underlying the increase in US yields was the strength of the US economy.

US Fixed Income and Fed Commentary

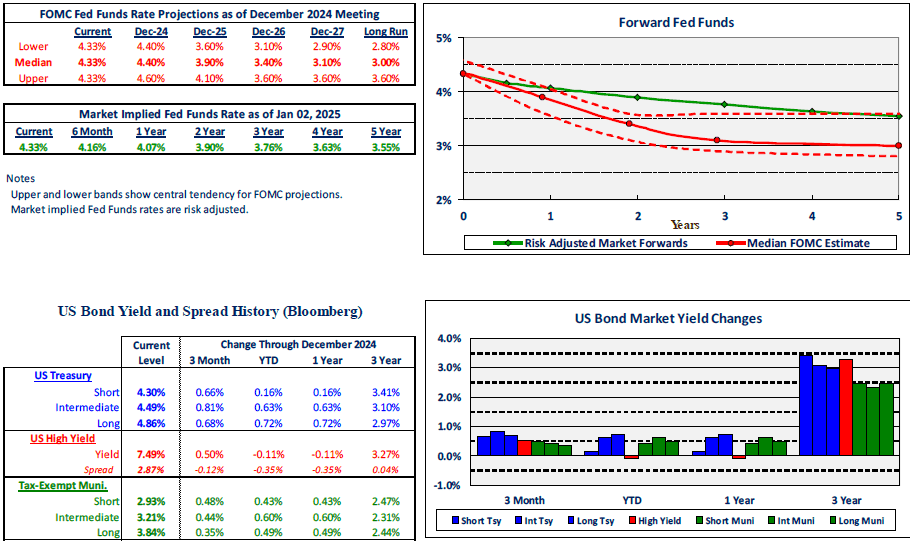

- In the fourth quarter, yields on longer-term Treasury bonds moved in the opposite direction to very short-term interest rates. The FOMC cut the Fed Funds rate at their two meetings during the quarter: by 25 basis points in November and another 25 bps in December. However, their communications after the meetings indicated that – due to continued economic strength, low unemployment, and inflation that remained stuck above their 2% target – future rate cuts were less likely than investors had been anticipating. With revised expectations of a higher future path of the Fed Funds rate, bond pricing incorporated higher underlying rates for almost all maturities.

- Some market participants also attributed a portion of the interest rate increases to the results of the election in November. With Trump returning to the White House and Republicans gaining control of both the House and Senate, these pundits believe that the likelihood of the federal government addressing its large budget deficit and outstanding debt is severely diminished. In addition, good GDP growth suppressed expectations of a recession or even a soft landing.

- Although the Treasury yield curve rose sharply leading to losses in high-quality fixed income – especially for longer-maturity rate-sensitive bonds – credit spreads narrowed. US economic growth and equity market strength kept default risks subdued. As a result, spreads in most sectors finished the year at levels at or near their all-time historical lows.

Stairway Partners, LLC © 2024

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.