Global Market and Economic Perspective

Global Economic Commentary

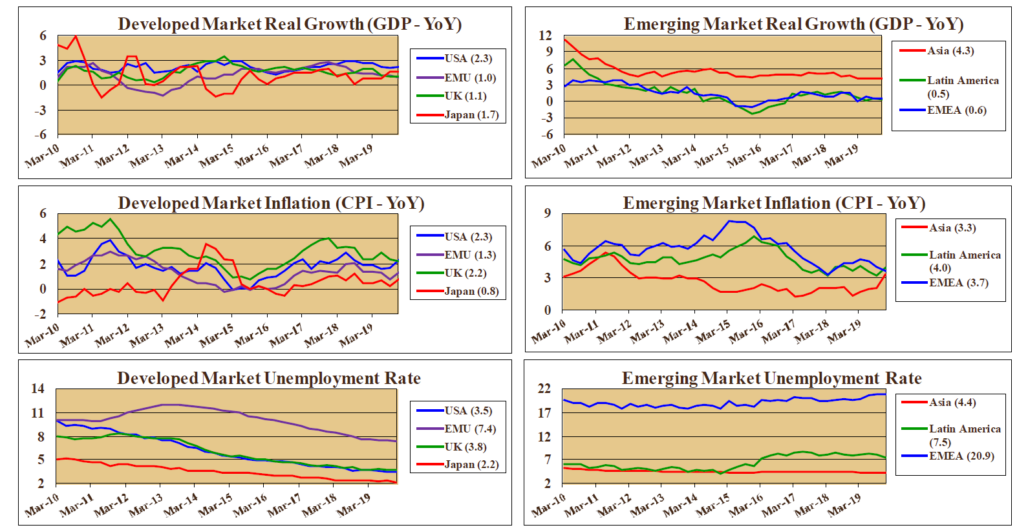

- The US economy remained on an upward trajectory in 2019. The current decade-long recovery since the global financial crisis is a record for economic expansions in the US. Fourth-quarter GDP growth was not overly strong, at a bit over 2%, due to a somewhat slower increase in consumption and weak private investment. However, stronger exports and a contraction in imports provided a boost to output growth.

- The growth picture outside the US was mixed, with Europe continuing to show weak but positive growth. Germany, the economic engine of continental Europe, remained weak, as manufacturing – especially in the auto sector – was soft. Brexit continued to weigh on the UK economy, although November brought closure to this issue, when the Conservatives – running on a “get Brexit done” platform – handed the Labour party its worst loss since the 1930s. GDP growth in emerging markets was also soft, with China experiencing growth of barely 6%, its slowest rate in decades.

- Despite the soft growth picture, many countries and regions saw unemployment remain low or even fall further. The 3.5% unemployment rate in the US is the lowest in 50 years.

- Given continued expansion and relatively tight labor markets, inflation ticked up moderately in the fourth quarter. However, inflation rates have largely stayed at or below central banks’ targets despite fairly loose monetary policies.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

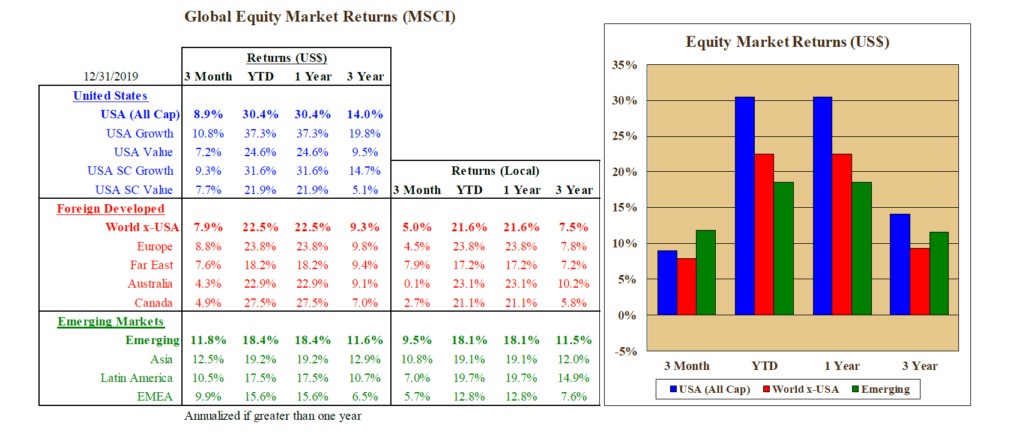

- Equity returns for the fourth quarter and full-year 2019 were very strong, not only in the US but also in non-US developed markets and emerging markets. Some of this can be attributed to the strong reversal of the sharp decline experienced at the end of 2018.

- In many cases, much of the equity market gain resulted from pricing “improvement” as earnings were lower or only slightly higher in 2019 than in the prior year. This was particularly true in China, where bad debt troubles and the trade conflict with the US created headwinds that hampered profitability.

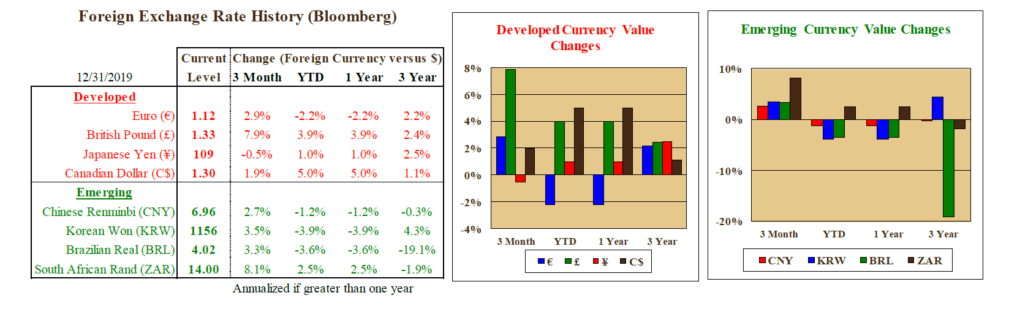

- During the fourth quarter of 2019, returns in non-US equity markets were boosted by a weaker US dollar. The dollar’s decline meant that it erased a portion of its overvaluation; however, it remains expensive relative to many currencies. The weakening dollar in the fourth quarter was in contrast to the full year, when net currency movements were close to zero and therefore contributed very little to the local market returns.

US Fixed Income and Fed Commentary

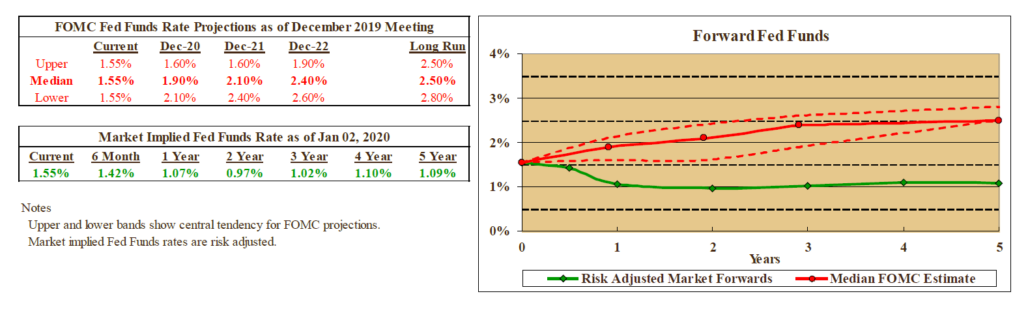

- In November, the Federal Reserve cut the Fed funds interest rate by a quarter of a percentage point for the third time of the year. This action took the rate to a range of 1.50% to 1.75%. Chairman Powell announced that the Fed was unlikely to provide further cuts unless there was a material negative change in the Fed’s outlook for the economy. In addition, he indicated that monetary conditions were sufficiently accommodative to assure continued economic expansion. (This view is supported by the Chicago Fed’s index of financial conditions, which shows conditions to be “loose”.)

- Four central banks – the ECB, Bank of Japan, Switzerland, and Denmark – continued to hold their short-term policy rates in negative territory. However, in December, Sweden’s central bank announced that they would raise their policy rate from -0.25% to 0.0%; they and others had begun to question whether negative interest rates were actually harming rather than helping their economic vitality.

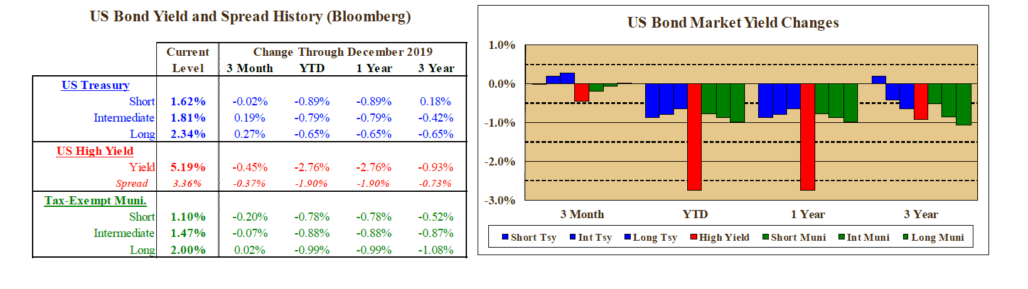

- Intermediate and long-term Treasury bonds produced negative returns during the fourth quarter, as yields on those bonds rose and the yield curve steepened. In contrast, high yield bonds and investment grade credits delivered positive returns due to narrowing credit spreads.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.